Additive manufacturing and the auto industry have formed quite the partnership. From prototyping to auto racing to keeping companies afloat despite supply chain issues, the relationship is only expected to grow.

A 2019 report by SmartTech Analysis projects the automotive additive manufacturing market to be worth more than $12 billion by 2028, which would be a drastic increase from $1 billion in 2017.

Granted, this estimate was released just before the coronavirus pandemic plagued countless companies and industries. According to Scott Dunham, executive director of research at SmartTech Analysis, the short-term impacts were much more pronounced.

3D printing hardware sales were greatly reduced, but in the second half of 2020 and throughout 2021, the industry saw a rebound.

The long-term outlook was not affected much from what was seen in the 2019 report, nor was the forecast. Because the pandemic thrust digital manufacturing and supply chain flexibility trends to the forefront, the predictions might even be more robust.

“The automotive industry, at the time that report came out, its use of 3D printing had been increasing in one sense that there were more exploratory projects,” Dunham said. “The industry’s use of 3D printing during that time had been scaling back just a little bit. That was the rapid prototyping side of things where a lot of the technology had been rooted historically. That was mainly auto industry trends; not so much a commentary on the technology.”

Eventually, auto companies will be looking for end-use, direct production applications in larger volumes, if possible. This leads to 3D printing companies entering the scene to meet potential requirements.

For now, OEMs are picking what Dunham calls “pet projects” to utilize 3D printing.

“It’s like they pick [a project] specifically for AM because it’s a vehicle that makes sense in the realm of today’s AM technology. It’s something that pushes the brand, but it isn’t going to sell huge units.”

An example of a pet project was covered by Michael Molitch-Hou, the editor-in-chief of 3DPrint.com. It involves Ford releasing CAD files that grant 2022 Maverick owners the ability to 3D print customized components for the pickup.

Molitch-Hou described it as something that should have happened in 2015 but explained how it could lead to further development.

“At the same time, the 3D printing technology and the industry itself has advanced to the point that we should see end parts in vehicles any day now,” Molitch-Hou said. “Ford itself claims by 2023; it’s going to have metal 3D-printed parts in a popular sedan. I feel like that Maverick story isn’t super indicative of where Ford is even at or where the market is at, but it still feels like a pilot project and they’re going to see if it takes hold.”

Implementing a minor 3D-printed contribution in the automotive industry is nothing new. One of the most prominent examples is 3D printing’s place in auto racing. As Molitch-Hou explains, 3D printing is helpful for one-off, complex parts that would prove too expensive to make with traditional manufacturing methods.

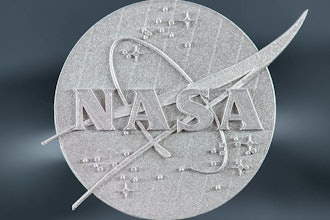

For example, in 2015, BMW announced its 500th water pump wheel to be 3D printed and fitted to a car’s powertrains. The first took place in 2010, when BMW used selective laser melting (SLM) technology to make a single-piece lightweight metal water pump wheel. It replaced multi-pieced water pump wheels, which were assembled with plastic parts in their German Touring Car Masters (DTM) race vehicles.

“Auto racing has proven to be a great use case for 3D printing,” Molitch-Hou said. “It is similar to the other fields like rocketry where it’s expensive and you’re only making one. The most cost-effective way to make a design tends to be 3D printing these days. That has led to many 3D printing manufacturers partnering with F1 teams, so they have certain deals going. It seems partially promotional and partially practical.”

As 3D printing evolves, several contributions have been introduced to the industry. Dunham and Molitch-Hou believe the most noteworthy contributions are the invention of printed sand casting molds and cores and metal binder jetting, respectively.

In the case of sand casting molds and cores, technologies are used from companies like ExOne, which is owned by Desktop Metal, or Voxeljet. These companies make printers that can print cores and shapes that can then be used in a traditional casting process to make metal parts. Essentially, it is printing the tooling used in the normal process.

“That may not be true in the future if we’re transitioning to more serial production through additive,” Dunham said on the usage of sand casting molds and cores. “But I suspect it will still be here for a long time to come because I think, overall, there’s not just a massive scale-up. It’s more of a gradual and incremental growth.”

Molitch-Hou described metal binder jetting as “an old but also new technology” and added automakers such as Ford and Volkswagen will use it to 3D print metal parts.

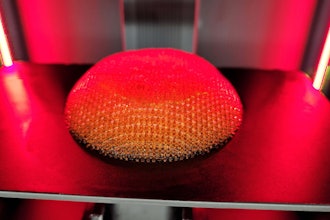

According to ExOne, binder jetting is “an additive manufacturing process in which an industrial printhead selectively deposits a liquid binding agent onto a thin layer of powder particles to build high-value and one-of-a-kind parts and tooling.”

“If we’re moving towards serial production with 3D printing, it seems like [binder jetting] is going to be the process in which they try to serially produce end parts,” Molitch-Hou said.

Other hardware from 3D printing companies such as multi-jet fusion from HP and digital light synthesis from Carbon focuses on automotive part production.

Dunham said he was impressed by the lack of product release delays during the pandemic and included metal powder bed fusion as a way to achieve high-volume production processes.

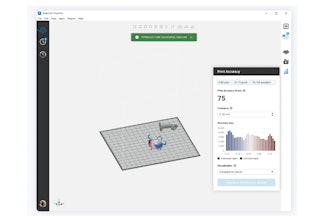

“One of the things powder bed fusion companies have tried to address and continually drop down is the cost per part. By adding more and more lasers to the systems, the throughput can go up. The machine cost goes up, but the cost per part, which is what automotive cares about, goes down. Now we have powder bed fusion manufacturers with eight to 12 lasers in a system whereas, historically, people said you could never control four at a time in a single machine,” Dunham said.

SmartTech’s report ends in 2028 with the automotive additive manufacturing market totaling north of $12 billion. It foretells parts production passing prototyping, tooling, hardware and materials to become the primary revenue opportunity.

In 2028, Dunham predicts a structure similar to today with a significant amount of prototyping and factory assistance. However, he also sees high-end models being 50% 3D-printed and, perhaps, a more significant influence on the mainstream area of automotive.

“If the binder jetting stuff can get off the ground a little more than it is today, we’ll start seeing, in six years, maybe the first break into mainstream automotive with 3D printing. It’ll probably be small metal parts at first.”